The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

Blog Article

Things about Eb5 Investment Immigration

Table of ContentsThe Of Eb5 Investment ImmigrationGetting My Eb5 Investment Immigration To Work9 Simple Techniques For Eb5 Investment ImmigrationLittle Known Questions About Eb5 Investment Immigration.The 9-Minute Rule for Eb5 Investment Immigration

While we aim to offer accurate and up-to-date material, it ought to not be thought about lawful guidance. Migration regulations and guidelines go through transform, and individual situations can differ extensively. For customized guidance and lawful recommendations regarding your certain migration circumstance, we strongly advise consulting with a qualified immigration attorney that can supply you with tailored help and make certain conformity with present laws and guidelines.

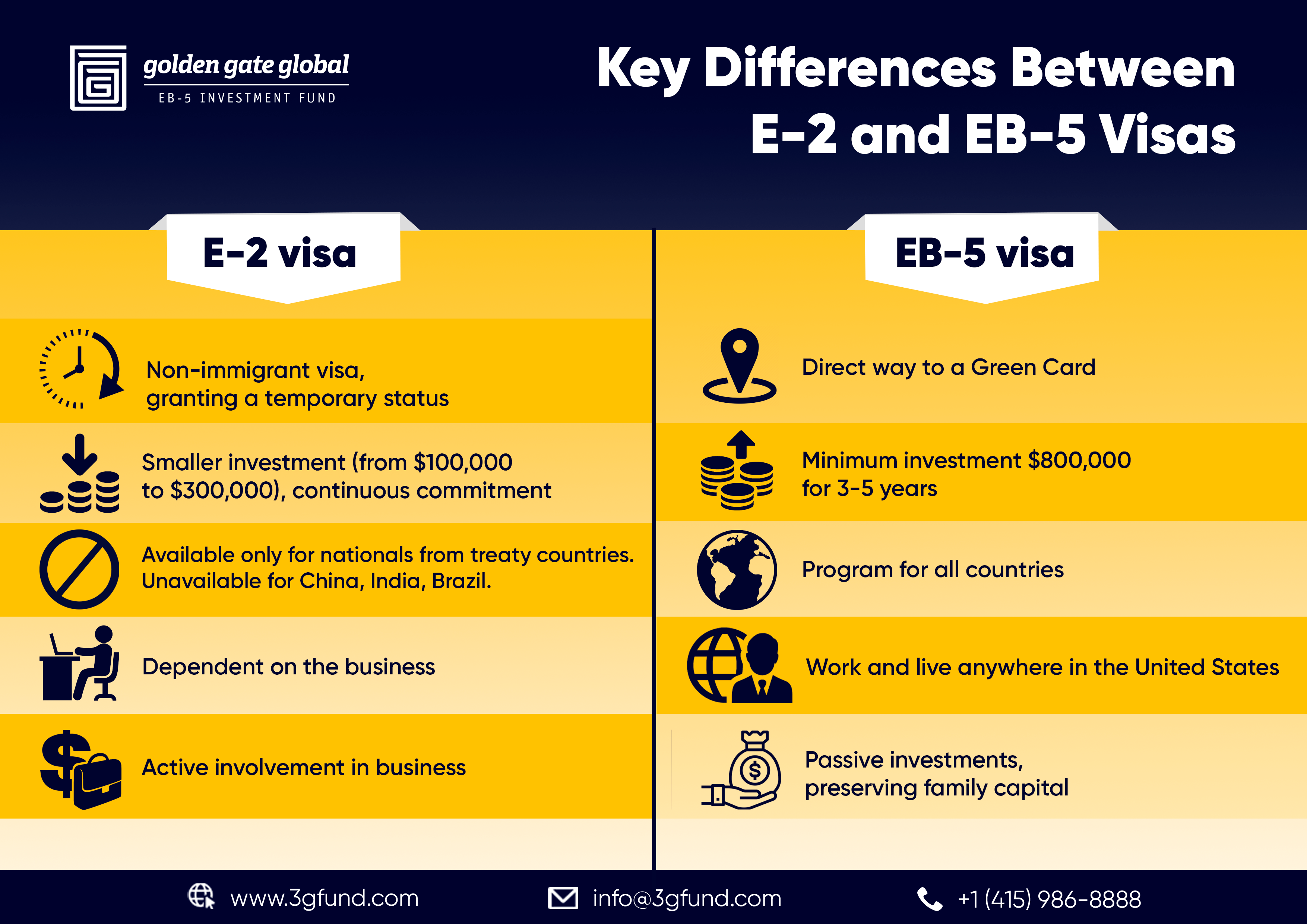

Citizenship, through investment. Presently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 in other places (non-TEA zones). Congress has authorized these amounts for the next five years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers must produce 10 full time united state jobs within two years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Need guarantees that financial investments add directly to the united state work market. This applies whether the work are developed directly by the commercial venture or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Some Known Details About Eb5 Investment Immigration

These jobs are determined via models that use inputs such as advancement expenses (e.g., building and devices expenses) or annual incomes generated by recurring procedures. In contrast, under the standalone, or direct, EB-5 Program, only direct, full time W-2 staff member settings within the business venture might be counted. An essential threat of depending entirely on direct employees is that team reductions because of market problems might cause not enough full time positions, potentially leading to USCIS denial of the financier's application if the work creation requirement is not satisfied.

The economic model after that predicts the number of direct work the new service is most likely to develop based upon its expected profits. Indirect tasks computed via financial models describes work created in industries that supply the items or services to business directly associated with the project. These jobs are developed as a result of the enhanced need for products, products, or solutions that support business's try this website procedures.

Eb5 Investment Immigration Things To Know Before You Buy

An employment-based 5th choice category (EB-5) financial investment visa provides a technique of becoming a permanent U.S. citizen for foreign nationals wanting to invest capital in the United States. In order to make an application for this environment-friendly card, a foreign financier has to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and develop or preserve a minimum of 10 full-time tasks for USA employees (excluding the capitalist and their immediate household).

This step has been a significant success. Today, 95% of all EB-5 capital is elevated and invested by Regional Centers. Given that the 2008 economic crisis, accessibility to capital has been tightened and community budget plans remain to face considerable shortages. In numerous regions, EB-5 financial investments have actually filled up the funding void, supplying a brand-new, vital source of funding for local financial growth projects that revitalize neighborhoods, create and sustain work, framework, and solutions.

Eb5 Investment Immigration Fundamentals Explained

employees. In addition, the Congressional Spending Plan Office (CBO) racked up the program as earnings neutral, with management prices spent for by candidate charges. EB5 Investment Immigration. More than 25 nations, including Australia and the UK, usage similar programs to bring in international financial investments. The American program is much more rigid than several others, needing significant threat for capitalists in terms of both their economic investment and immigration standing.

Households and people who seek to relocate to the United States on an irreversible basis can use for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) set out different needs to obtain long-term residency via the EB-5 visa program.: The first step is to find a qualifying financial investment possibility.

As soon as the possibility has actually been determined, the financier needs to make the financial investment and Clicking Here send an I-526 request to the united state Citizenship and Migration Provider (USCIS). This application has to consist of evidence of the financial investment, such as financial institution declarations, purchase agreements, and company plans. The USCIS will review the I-526 request and either accept it or demand extra evidence.

All about Eb5 Investment Immigration

The capitalist must look for conditional residency by sending an I-485 petition. This application needs to be sent within 6 months of the I-526 approval and have to include proof that the financial investment was made and that it has actually developed at the very least 10 permanent tasks for united state workers. The USCIS will review the I-485 petition and either accept it or request added evidence.

Report this page